Horizon Insights founding team initially focused on macroeconomic research starting from 2005, which has earned us a strong reputation and market position among institutional investors. Beginning with our first PMI analysis and grassroots research reports, our FICC team has expanded its focus from top-level macro trends down to mid and downstream industrial sectors. Our research methodology has evolved to connect macroeconomic logic with commodity fundamentals, adopting a more strategic and actionable approach. Utilizing our proprietary ETA data analytics platform, we serve over 600 clients globally. 70% of these are enterprises, including industry leaders in bulk commodities, large listed companies, and Fortune 500 companies; the remaining 30% are financial institutions, including exchanges, banks, securities firms, private equity, asset management, overseas hedge funds, etc.

Research Features

A Top-down Research Framework

Successful History: with 16 years of research experience, our research coverage spans global macro and fundamentals.

Multi-Dimensional: our top-down research framework captures evolution of economic cycle and fundamental developments.

Strategy Provider: we deliver clear trading strategies alongside our research logic, which suits the need of all kinds of institutional clients.

A One-Stop Shop for Data and Analysis

Comprehensive Data Source: we have access to major data platforms such as Bloomberg, MySteel, Wind, and specialized 3rd party providers such as Kpler. We also collect survey and other alternative data in our online portal.

Technology-Empowered: our self-developed research portal satisfies your daily need of data processing, modeling, visualization, reporting etc.

In-house Tech Team: our 30-ppl tech team upgrades our online research portal from every day to serve your everchanging needs.

An Information Center with Wide Industry Coverage

Industry Coverage: we are currently working with the top 15 trading firms and 70% of the steel mills in China.

Frequent Communication: each analyst is a go to person for first-hand market information through daily communications with our industrial clients.

Instant Feedback: we react fast to market signals through expert calls, surveys, closed-door meetings from time to time to capture first-hand information.

Diversified and Customizable Products

Frequency VS Depth: we maintain daily communications with our clients.

Our research deliveries differed by frequency (from daily recap to annual outlook) and depth (from real-time updates to in-depth analysis).

Modular Subscription Model: depending on your needs and product requirements, our subscription can be tailored to fit them.

Customization: we provide standardized products such as research reports, concalls, roadshow, offline collaborative seminars with exchanges. We also provide customized research projects and products as per your request.

Service Coverage:

FICC department consists of 4 research units, 3 sales team, a survey unit and an in-house IT team. Our research covers global macroeconomic, ferrous metals, base metals, energy and petrochemicals.

- Macro, stocks and bonds, precious metals, chemicals, ferrous, non-ferrous daily and weekly strategy research.

- Overnight interpretation of fluctuations in European and American capital markets and event commentary voice recap.

- Real estate, infrastructure, automotive, foreign exchange, exports, energy, and other thematic bi-weekly in-depth reports.

- Online/offline salon discussions on market hot topics.

- Timely commentary on economic, financial, and industrial inventory data.

- Research services of online Q&A platforms and analytical chart libraries.

Past Research Highlights:

- Q1 2019: China's inventory cycle swings in 2019.

- Q4 2019: The expected return of real estate is declining, which is the core of future asset allocation.

- Q3 2020: Inflation expectations rise, the price elasticity of commodities next year is higher than stock assets.

- Q3 2021: The Fed enters a tightening cycle, and U.S. Treasury yields strengthen.

- Q2 2022: Domestic epidemic + U.S. inversion, demand shock exceeds expectations.

- January 2023: Market trades on domestic recovery + U.S. soft landing.

- April 2023: This year's economy is "N-shaped," focus on the sequential recovery in May-June.

- August 2023: Continue to be bullish on oil prices, but oil prices become the X-factor, affecting U.S. bonds.

Our Offerings - FICC

Research Reports

Daily / Weekly / Bi-Weekly / Monthly / Semi-Annual Reports

Monthly Field Surveys

Customized Research Reports

Roadshows

- Virtual / Face-to-Face interactions with our analysts

- As per client’s topic of choice, our analysts will prepare a deck featuring key insights, developments, trends, price predictions, trading strategies etc.

- Q&A – More interactive and fruitful discussion of the market with our specialists

Consultation

Quick turn around of information – Our sales representatives and analysts maintain frequent communication with our clients to ensure that all information is up-to-date

Closed Door Meetings – We gather all our clients to exchange ideas and share their current market sentiments

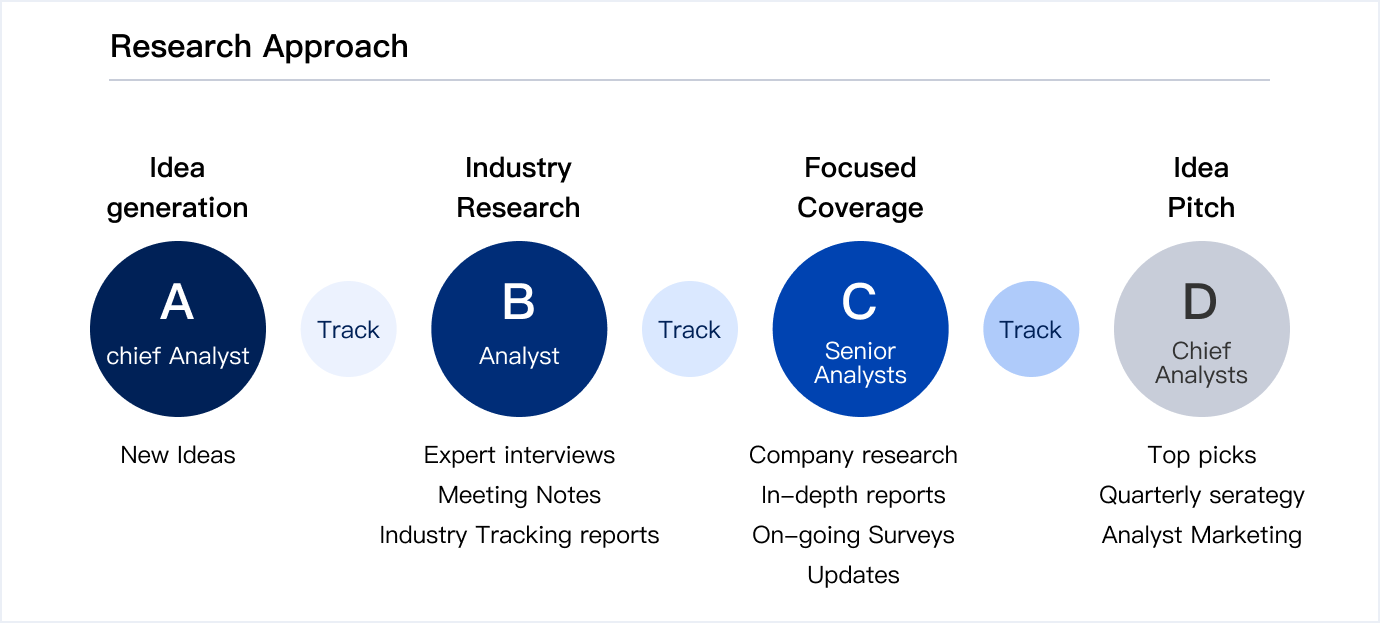

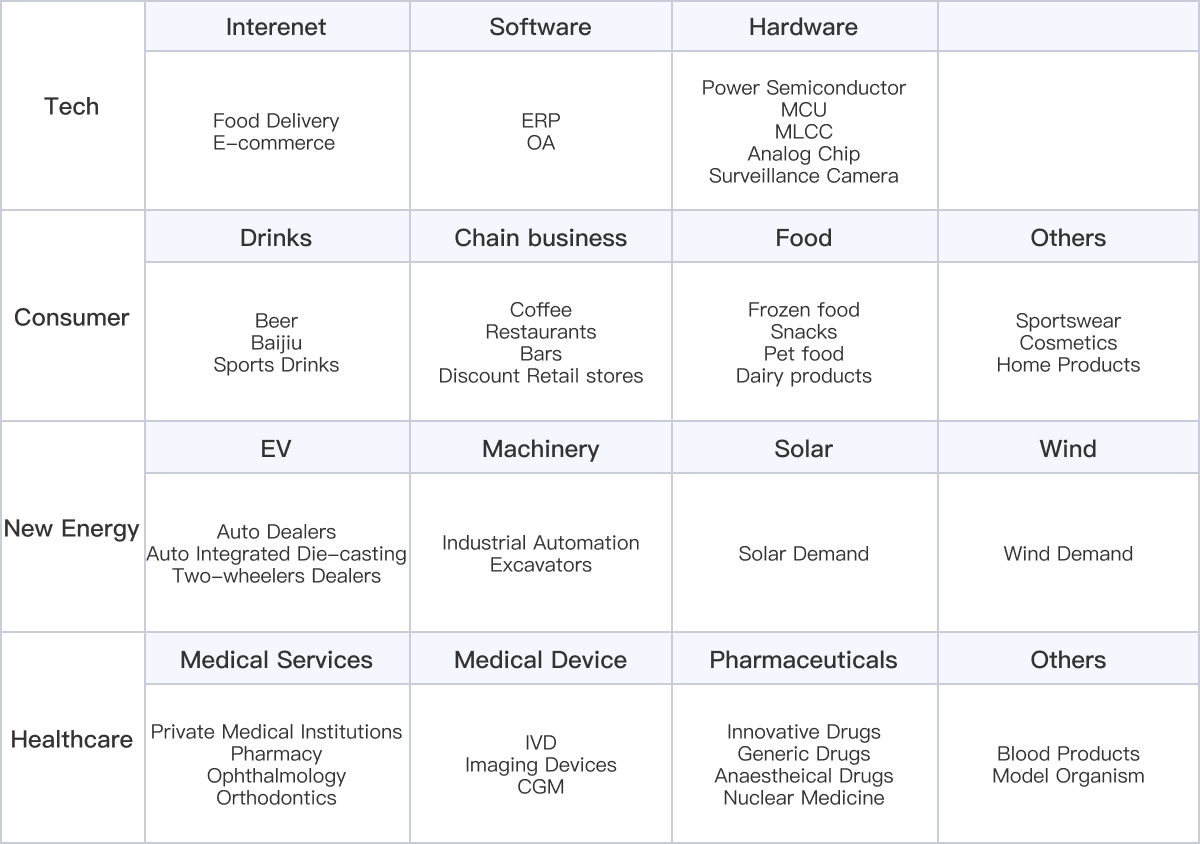

2、Horizon Insights Equity ResearchOn-the-ground Tracking: Comprehensive and unbiased tracking across 50+ sectors like ERP, power semiconductor, pet food, beer, sportswear, auto supply chain, innovative drugs, medical devices and etc.

Global Innovation Focus: Regular engagement with overseas top companies to stay abreast of global innovation and R&D advancements.

Identifying Early Growth Opportunities: Utilizing high-frequency data, we identify emerging trends in the industry, corroborate them through upstream and downstream analysis, and logically infer the most promising sub-sectors affected by these changes.

Cross-Industry Focus: Going beyond traditional industry classifications to provide in-depth cross-industry comparisons, focusing on industry-specific demand drivers and business model characteristics.

Target Selection: A curated list of over 80-100 core investment targets under coverage.

Our Offerings - Equity Research

Industry Weekly: A weekly summary of industry research.

Initiation Reports: Individual stock in-depth reports

Channel Check Reports: A quarterly summary tracking 50+ covered sub sectors.

Analyst Access & Corporate Access

Virtual / Face-to-Face interactions with our analysts

Corporate access: 400 companies

Quick turn around of information – Our sales representatives and analysts maintain frequent communication with our clients to ensure that all information is up-to-date

Our ‘OTG’ Surveys - Equity Research

We offer 20-30 group calls each week. Call minutes are made available the following week.

Horizon Insights Research is dedicated to offering global investors data-driven, market-focused research and investment services on the Chinese economy. Utilizing in-depth, on-the-ground research covering China's economic, industrial, and market cycles, we have amassed extensive data and models. These tools not only provide a comprehensive view of the Chinese economy but also power Horizon Insights' proprietary intelligent data platform and AI models. Our expertise enables us to identify economic inflection points, offering investors actionable research solutions for investment.

Empowered by data and technology, we are committed to providing unparalleled insights into China's economic landscape amid the complexities of the market. Our aim is to share the benefits of China's economic growth with you.

Research Features:

Stable Investment Research Framework: Through a deep understanding of China's economic and financial cycles, industry traits, and macro-environment, we identify pivotal market shifts. This enables us to make timely and accurate forecasts on key financial market developments.

Data-Driven Analysis: We focus on leading indicators in economic and financial markets, develop proprietary and efficient market models, and quantify our research methods. This enhances the traceability and scalability of our analyses.

Bottom-Up Research: We supplement the gaps in macro-level research by thoroughly understanding investment opportunities in the Chinese market.

Tool-Based Approach: We offer a comprehensive, large-scale, and flexible data model platform. Investors can customize their data sets and research frameworks according to their specific needs.

Service Offerings:

Major Asset Allocation and A-Share Market Strategy Reports: Comprehensive guides for asset distribution and market strategies.

Daily Reviews and Interpretations: Timely reports on key events and data in China's economic and financial markets.

Weekly Observations: Reports focusing on investment hotspots in financial markets and macroeconomic research.

In-Depth Research: Detailed studies on critical topics in macroeconomics and financial markets.

Proprietary Data and Financial Model Services: A digital platform offering self-owned data and financial model research services.